Do I Qualify?

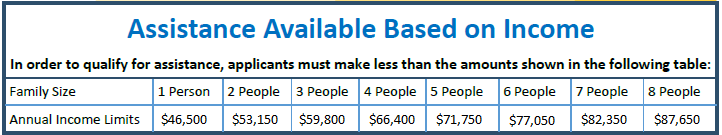

Assistance Available Based on Income

Who qualifies for assistance?

Any owner-occupant who meets the program’s income guidelines (see chart below) and who lives in Huron, SD, may apply. Applicants must own the home, and it must be their principal residence. A copy of an executed and recorded deed is needed to verify ownership. Homeowner’s must also have satisfactory credit, be current on all property taxes and mortgage payments, have a current homeowners insurance policy, and cannot have an open bankruptcy.

Fill out a pre-application today to see if you qualify!

Download the form below, complete it, and mail or deliver it to Huron Housing Authority.

How do I determine my Income?

All income for all adult household members received during a 12-month period must be counted. All income sources below must be included:

• Gross wages and salaries - before payroll deductions, overtime pay, commissions, fees, tips, and bonuses. |

• Net income from the operation of a business or profession including rental of real or personal property. |

|---|---|

• Interest, dividends, and other income from family assets. |

• Full amount of periodic payments received from Social Security after deductions of Medicare premiums (including social security received by adults on behalf of minors or by minors intended for their own support). |

• Payments in lieu of earnings, such as unemployment and disability compensation, workman’s compensation, and severance pay. |

• Periodic and determinable allowances - such as alimony and child support payments, and regularly recurring contributions or gifts received from person not residing in the dwelling. |

• Income received from annuities, insurance policies, retirement funds, pensions, disability or death benefits, and other similar types of periodic receipts, including a lump sum payment for the delayed start of a periodic payment. |

• All regular pay, special pay, and allowances of a member of the armed forces who is head of the family of spouse, whether or not that family member lives in the unit. |

Any earned income tax credit to the extent it exceeds income tax liability. |